Is Fisker (FSR Stock) the next Tesla instead of Lucid? Could it be acquired by BMW, Ford or Foxconn?

Fisker can potentially return 40x if it sells the 250k units as per management expectation.

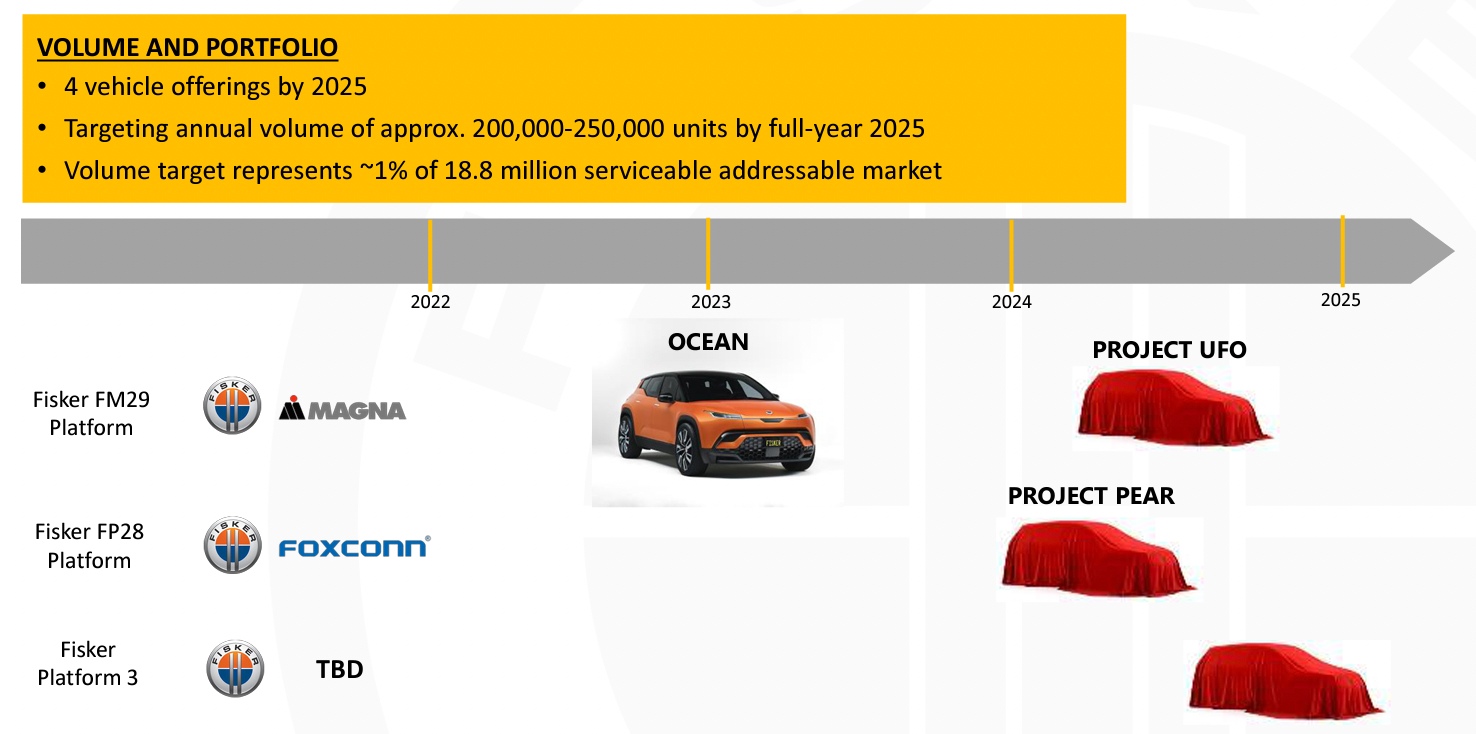

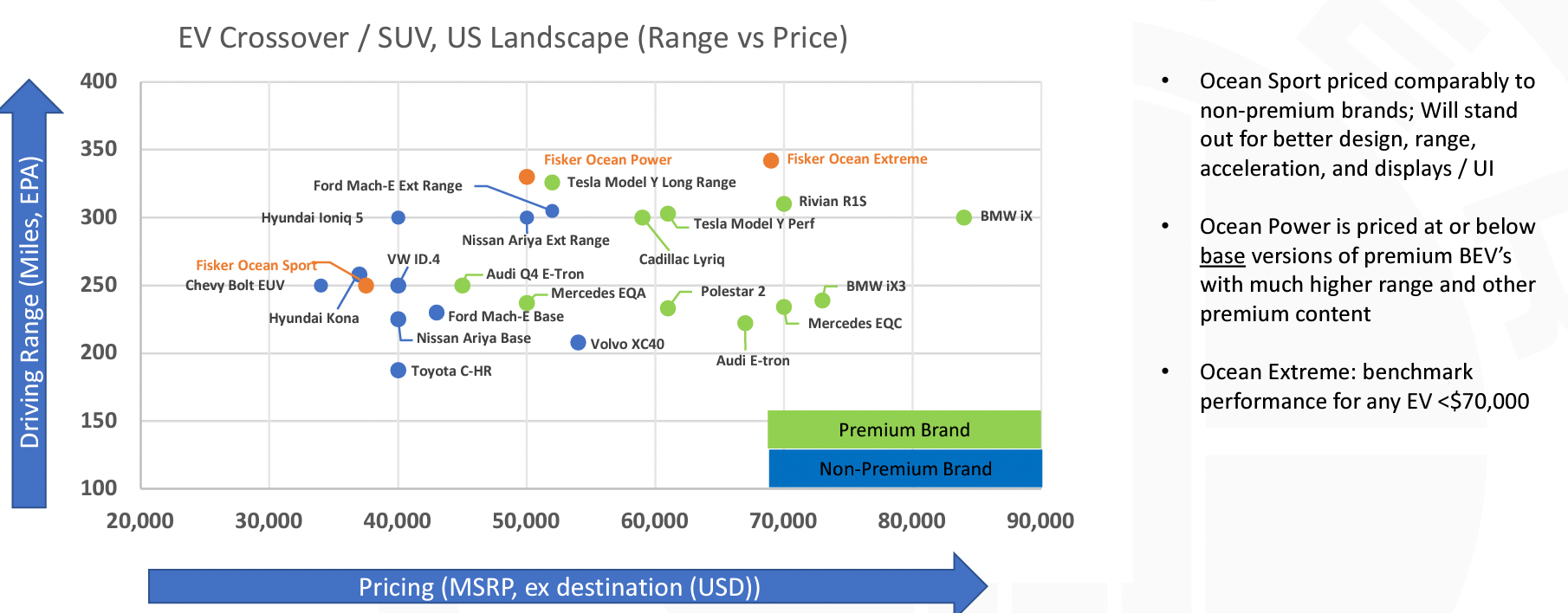

According to Fisker's Investor Presentation, its first EV, Ocean

is on-track for expected launch in November 2022;

Plan for ramp beyond 5,000 units per month during 2023.

Therefore, this makes Fisker a fairly early stage investment as all the sales and financial figures are just projections for now.

Investing at this stage would be somewhat similar to a VC investment where significant domain expertise is required to understand the technology and underlying dynamics (pricing, design, range) of the EV market, which is admittedly out of our range. However, we think even then, success is far from guaranteed given the high number of variables.

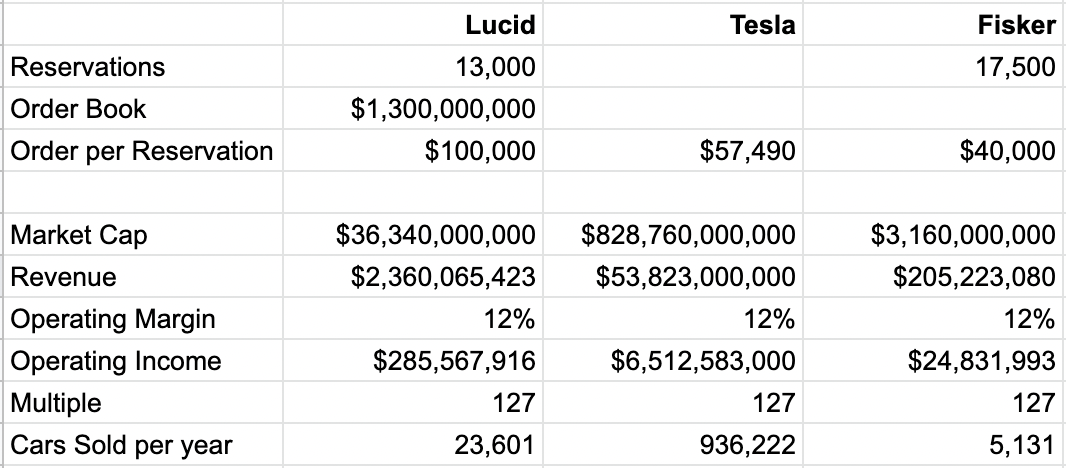

Nonetheless, it is still worth doing a simple comparison given we already have some data on Lucid and Tesla.

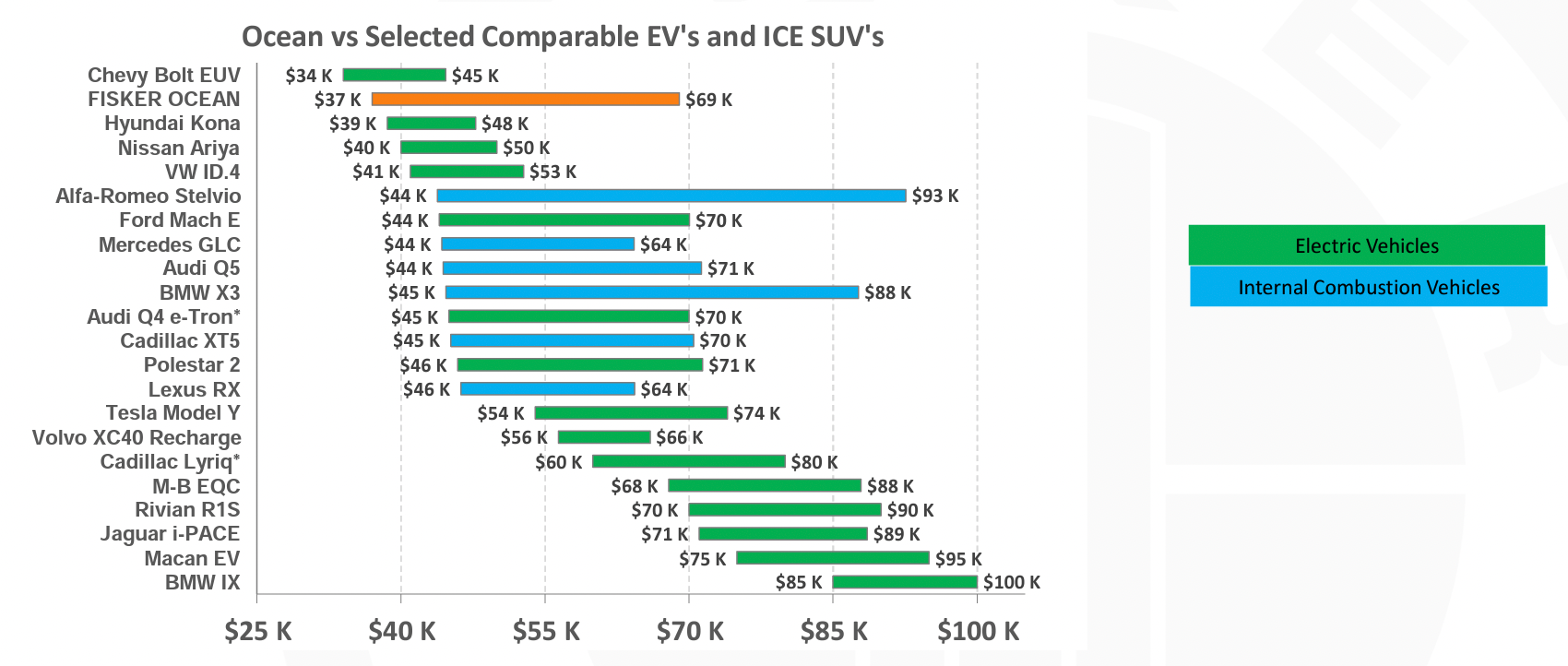

According to management, the Average Selling Price (ASP) is projected at "mid-$50k for Ocean at maturity (likely higher in first 1-2 full years based on industry norms) and in-line with 5 highest-selling ICE premium SUV’s ($49.1k-$55.4k)".

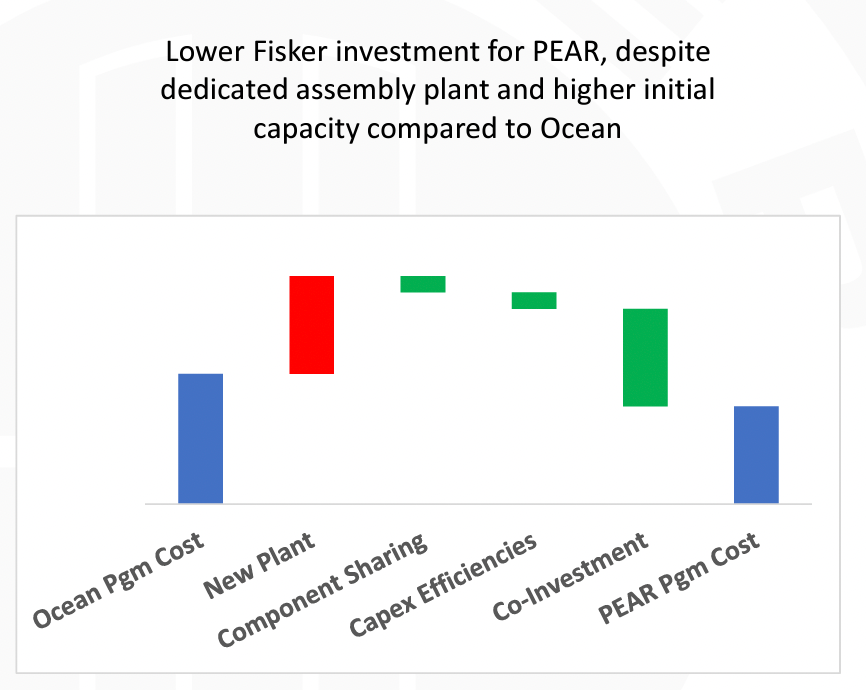

The next in line EV is Pear, which is a co-investment of Foxconn,

Expected start of production Q1 2024 in United States;

Expected pricing to start below $30k; meaningfully lower investment cost relative to Ocean

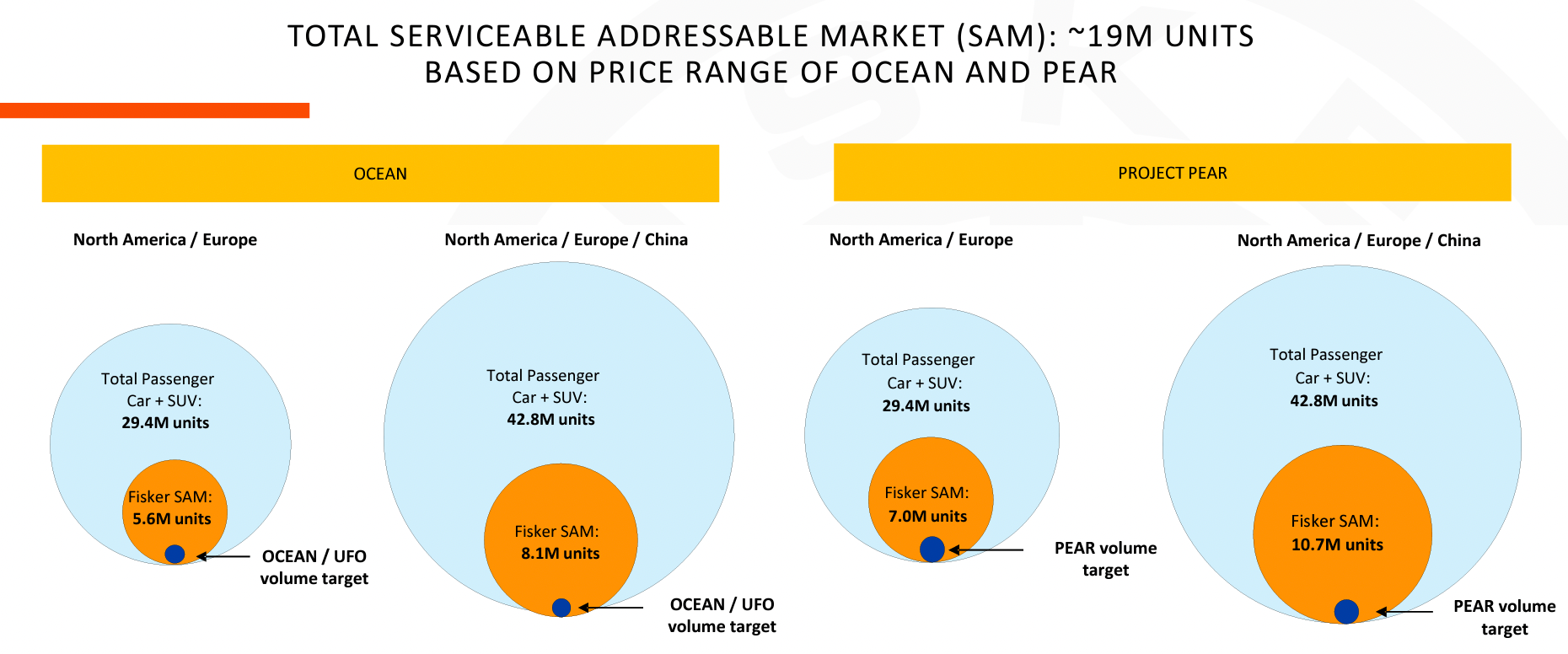

The volume target will always appear small given the relatively large market but as can be seen above, the competition is fairly intense with both traditional and upcoming brands.

Doing some simple calculations using the presentation and data above, one can make a number of observations:

1) Fisker's Order per Reservation/ASP is actually lower than both Lucid and Tesla.

2) Assuming similar operating margins and trading multiples, current valuation is pricing in Fisker selling around 5k cars per year, compares to management's expectations of 200-250k units by 2025 above. Therefore, the market is projecting

A) Fisker is not able to sell as many cars as it targets

B) lower operating margin

C) A and B above will both lead to a lower multiple

If we assume instead Fisker can indeed sell the 200-250k units then Fisker is trading at only 3x multiple so there is potential to make a 40x return on investment here.

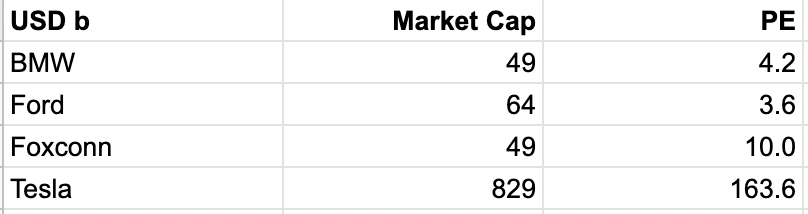

With this return potential, could Fisker which has a market cap of about USD3b currently be acquired by one of BMW, Ford, Foxconn or Tesla in the future?