Defense Stocks to Buy Now - BAE share price just broke 700 but it's still yielding >3% (March 2022 Update)

Is BAE re-rated as investors are willing to pay for a higher multiple or just expecting more growth amid international tensions?

BAE currently has a market cap of ~£23b with a free cash flow (fcf) of ~£1.9b implying ~12x fcf multiple. It has a dividend per share (dps) of £25.1 and at current BAE share price of £725, implies a 3.5% dividend yield.

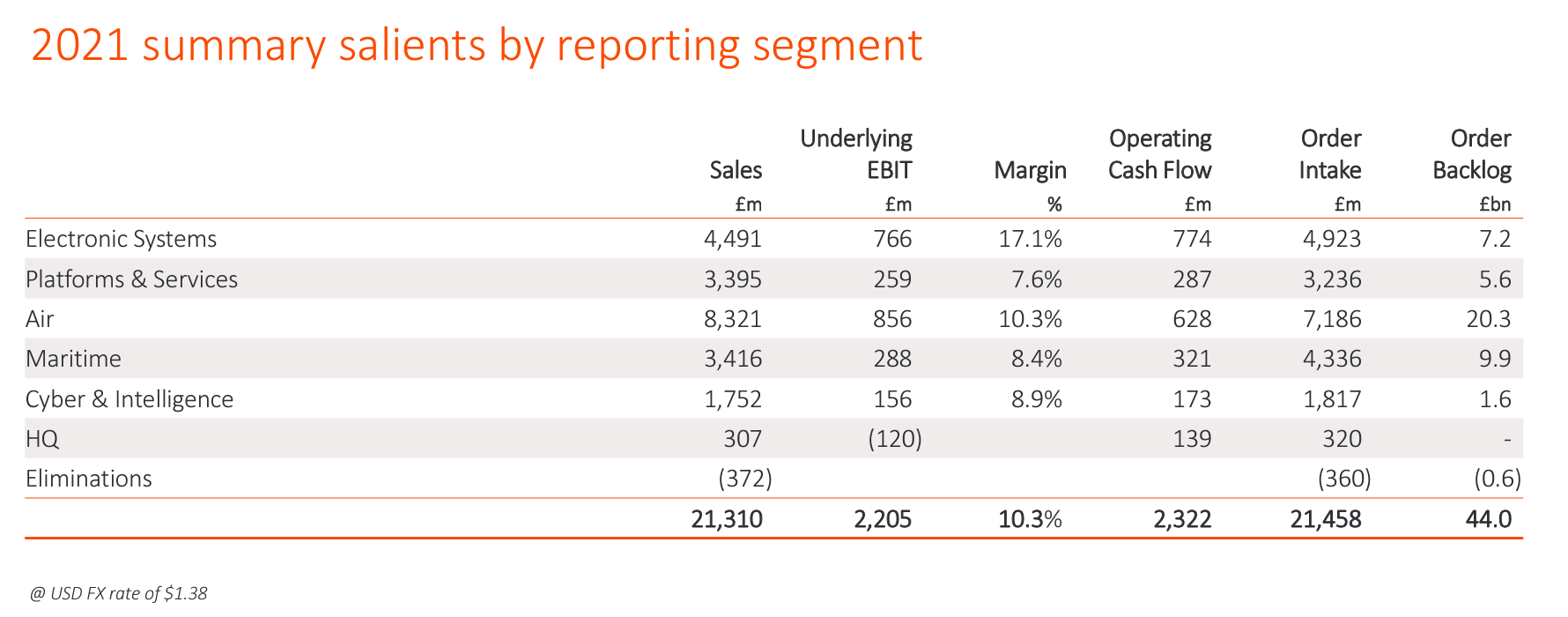

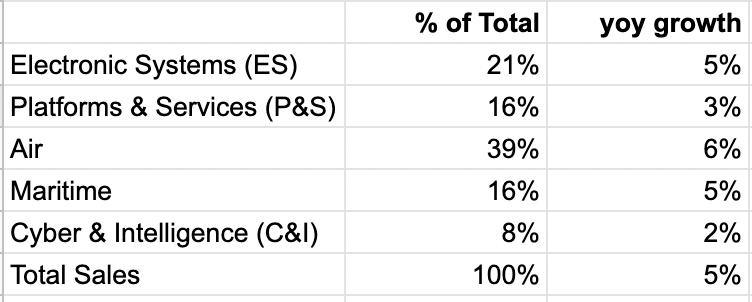

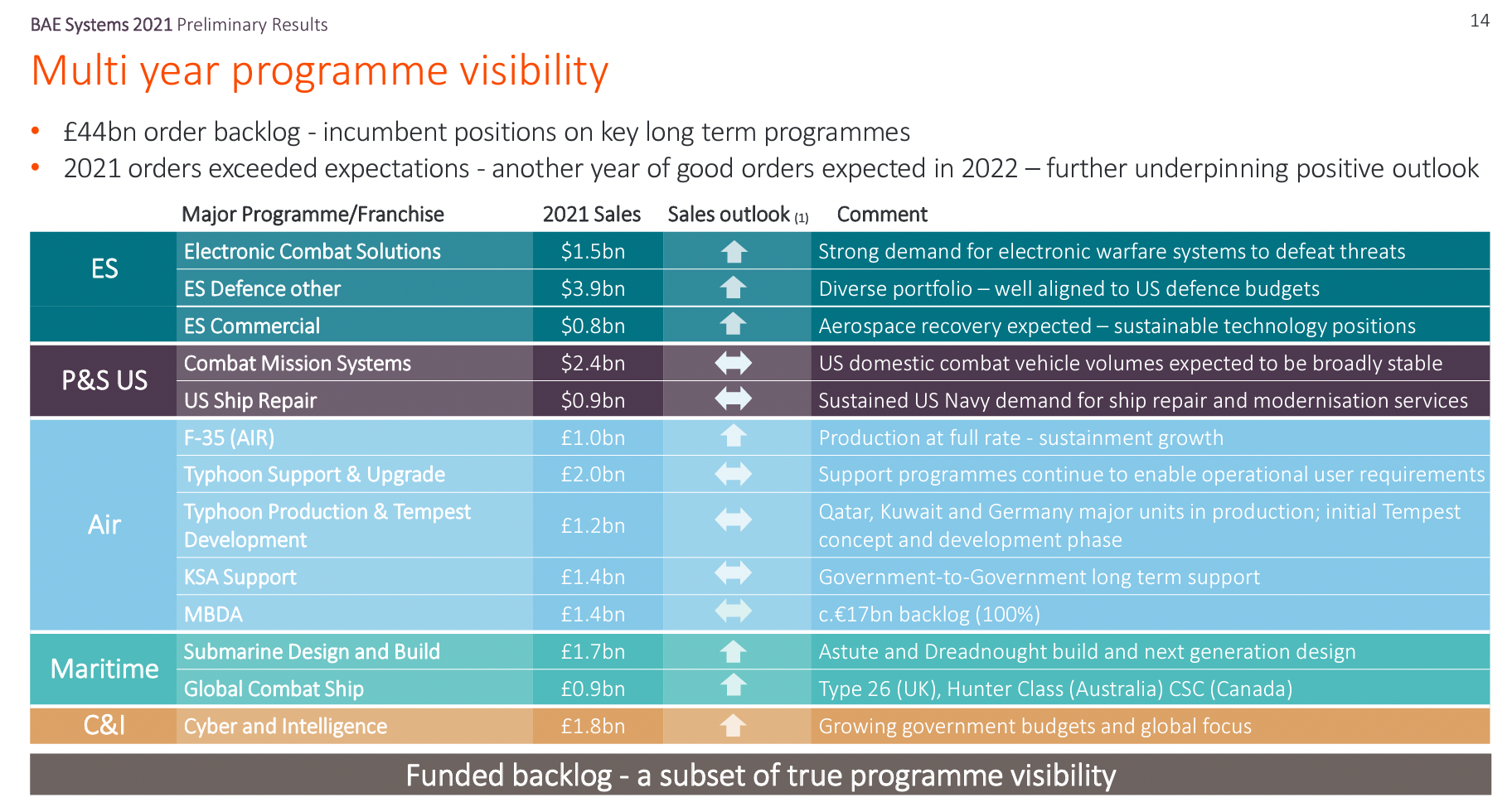

As per its 2021 Preliminary Results presentation, BAE's sales are divided into 5 segments as per below.

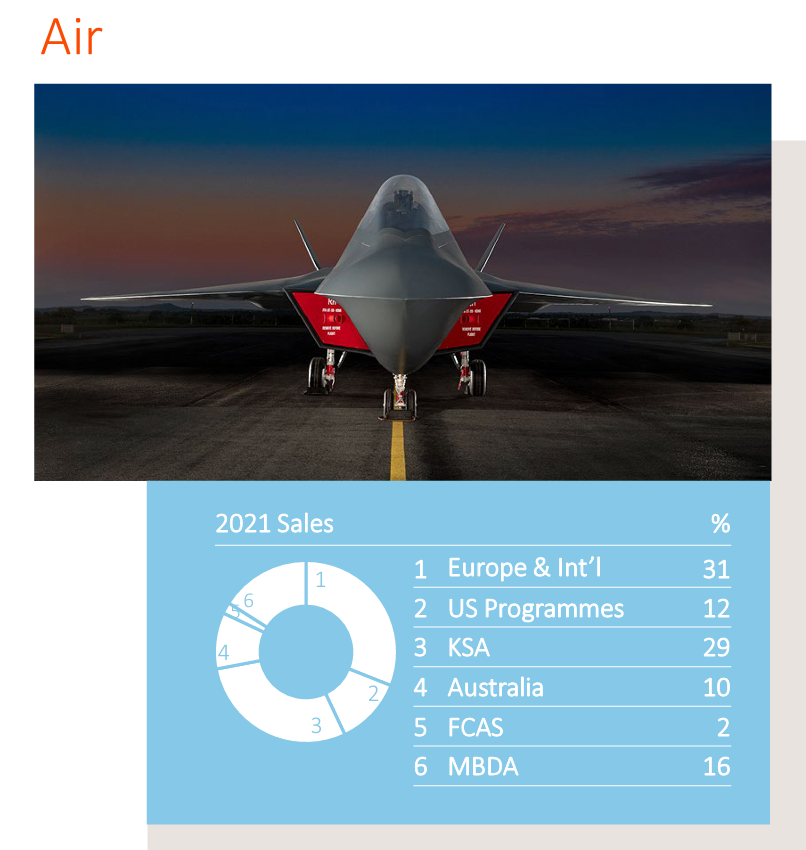

Air (39% of total sales) and ES (21%) are also the segments with the highest EBIT margins at 10% and 17% respectively.

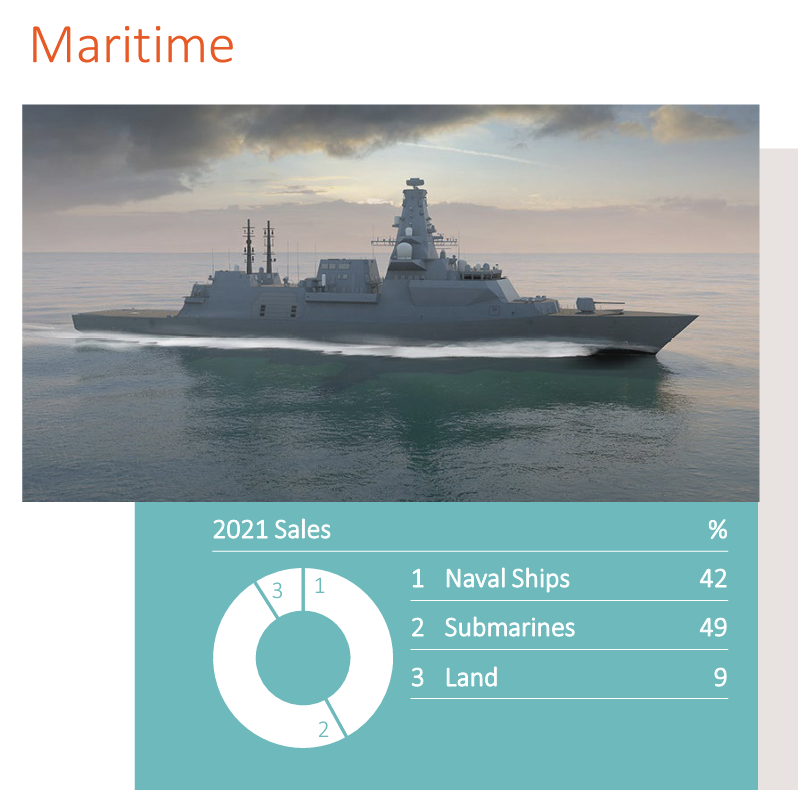

Key growth areas are ES, Maritime and C&I in terms of sales outlook.

However, it must be noted that BAE is not a growth stock with yoy sales growth at 5% only. So the spike in BAE share price is either

1) the market is expecting higher sales growth;

2) the market is willing to pay a higher multiple for similar growth; or

3) both

The key difference between 1) and 2) is if it is 1) then if sales do not rise as much as expected then BAE share price would likely correct.

If it is 2) then even if sales do not rise as much as expected as long as international tension remains high then BAE share price would likely sustain at a higher level due to the higher multiple. This is effectively a re-rating of the stock, which is more valuable from the BAE share price perspective. As it means investors are now willing to pay more premium for defense stocks like BAE compared with other stocks as investors are expecting BAE's future earnings ability to be sustained for longer under a tenser international scenario.

An intelligent investor will need to be able to see through this though it is extremely difficult to distill.

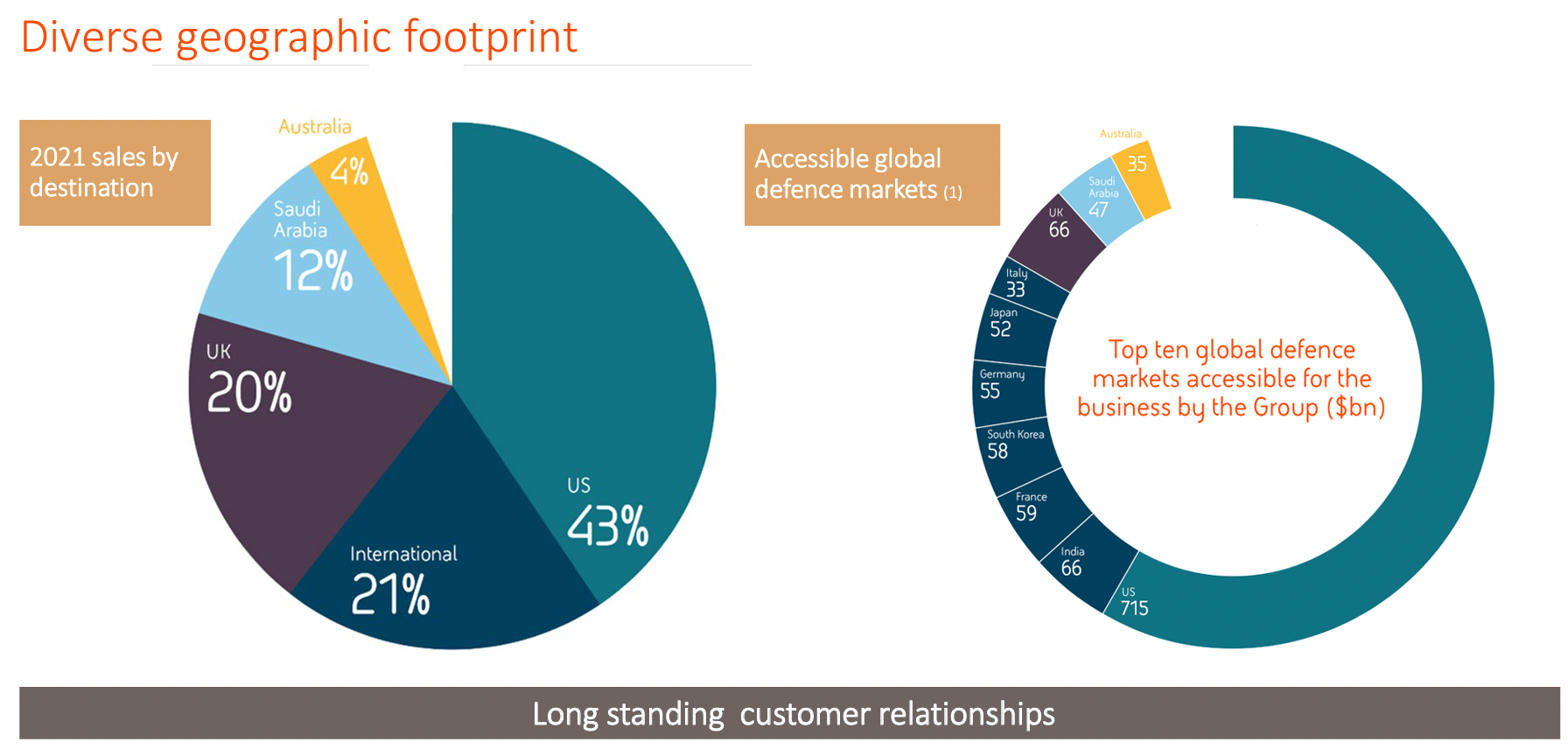

US remains the key market for BAE.

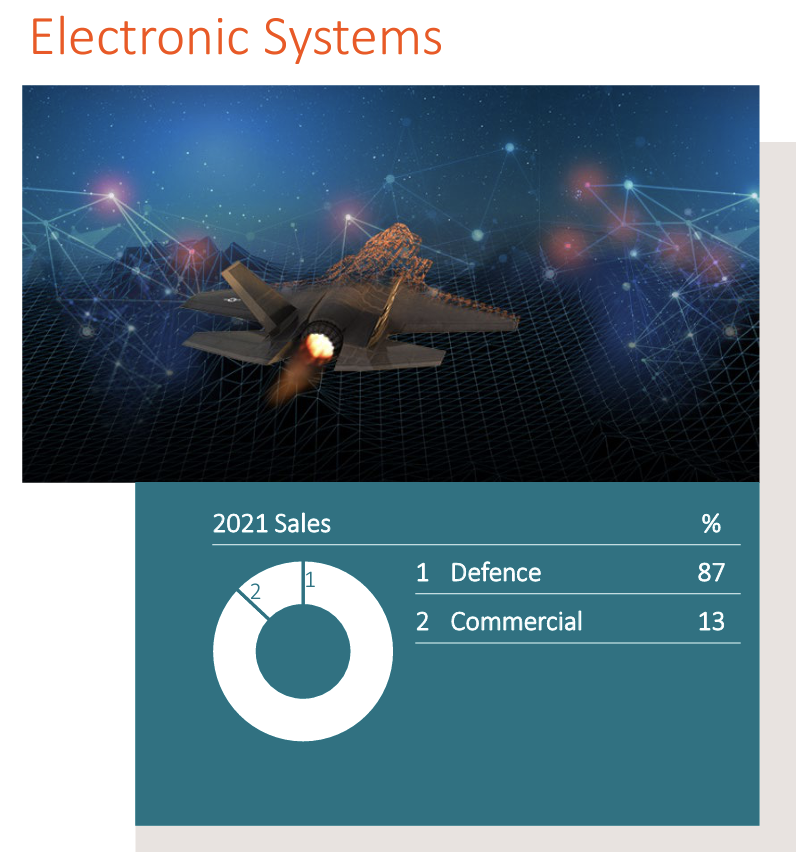

Majority or 87% of ES Sales is Defense related.

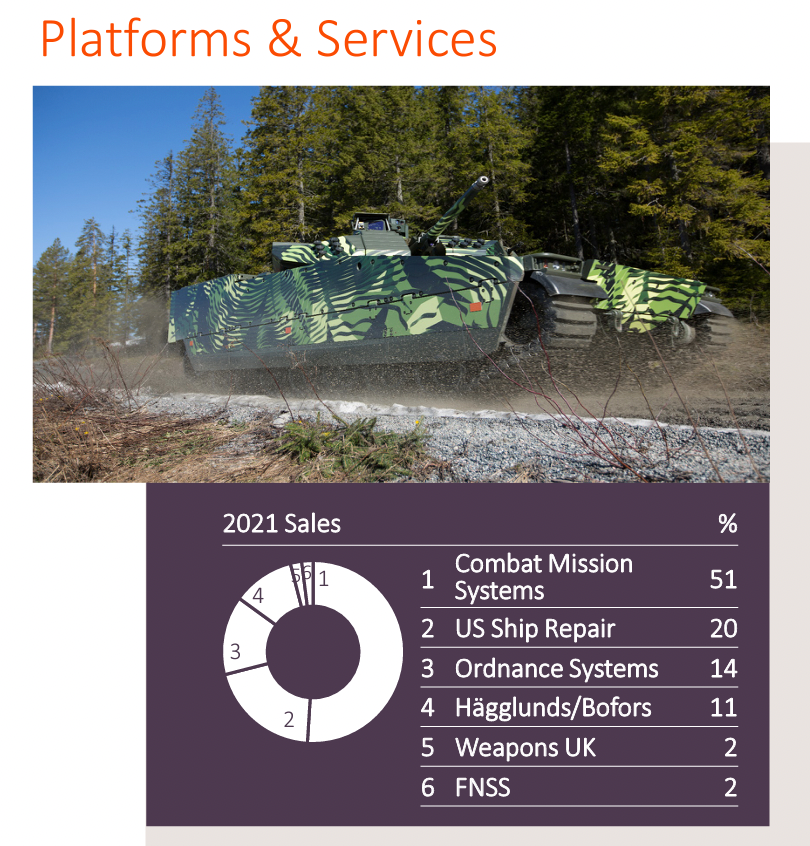

Similarly, majority or 51% of P&S Sales is Combat Mission Systems.

Air sales is mainly driven by Europe, International and Saudi Arabia.

Maritime sales are mainly Submarines and Naval Ships.

Majority of C&I sales are Intelligence & Security.