IPO Stocks to Buy Now - Coinbase (COIN stock) analysis (January 2022 Update)

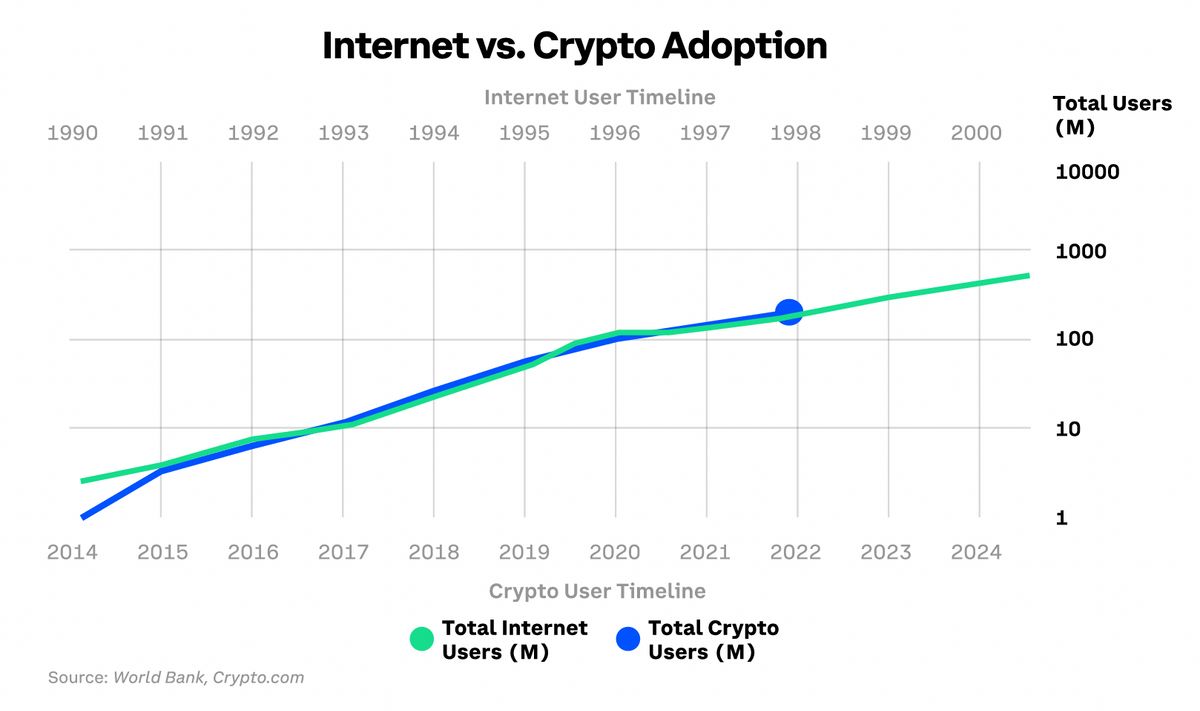

(January 2022 Update) One of the differences between investing in Coinbase and Bitcoin is proof of stake currencies will boost Coinbase's revenue structurally. Investing in Coinbase is ultimately investing in the adoption of cryptos as a utility, by how fast and how large.

~37% of the world's crypto users are on Coinbase

This figure is derived from Coinbase's Q3'21 Shareholder Letter,

according to the World Bank and crypto.com, the number of crypto users globally doubled in the first half of 2021 to over 200 million...

...In Q3, Verified Users grew to 73 million and retail Monthly Transacting Users (MTUs) were 7.4 million.

Further,

Crypto assets on Coinbase represented 12.2% of the total crypto market capitalization as of September 30, 2021.

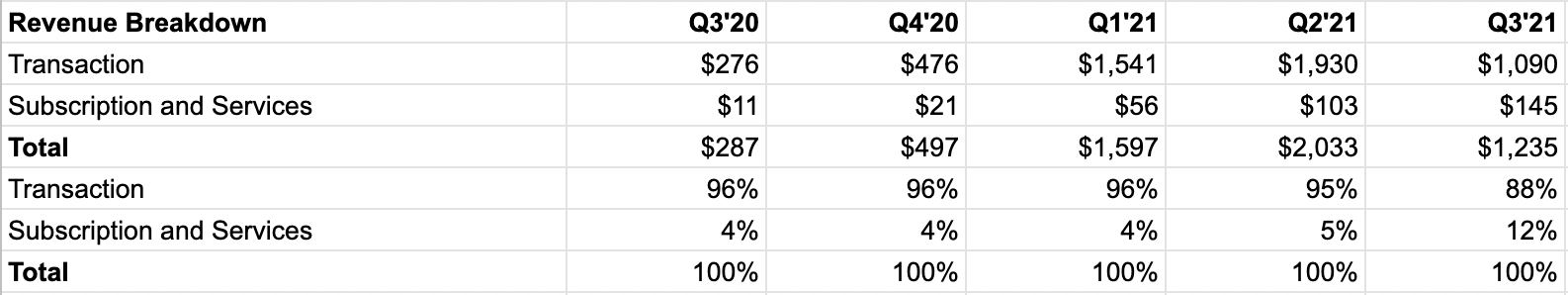

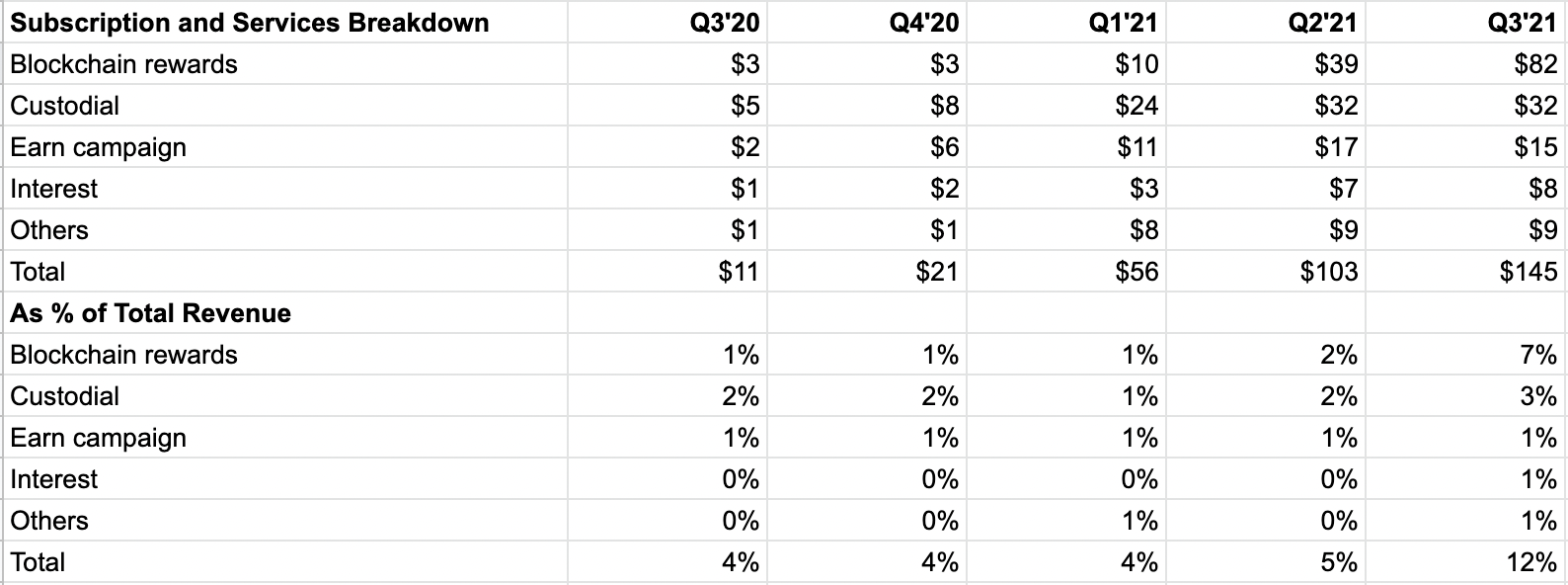

More stable subscription and services revenue is rising

As at Q3,21, transaction accounted for 88% of total revenue while subscription and services rose to 12%.

This trend should continue in the medium to long term with Coinbase's revenue mix looking very different in the future. Unless there is significant increase in trading volume or market cap of cryptocurrencies, which will boost transaction revenue more than subscription and services in the short term.

As transaction revenue is volatile, subscription and services should be valued more highly (literally with higher multiples) from investors. Therefore, the higher contribution from subscription and services should be considered a positive. Extract below from Coinbase's Q3'21 Shareholder Letter.

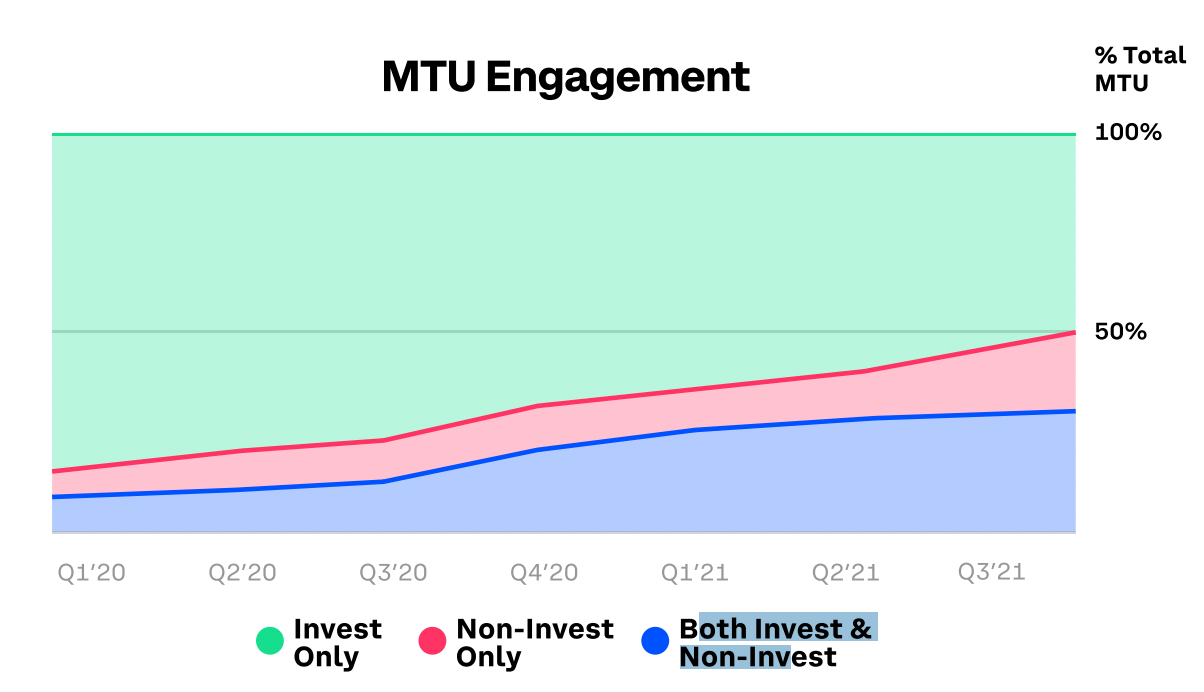

Growth in Subscription and services is an indicator that crypto is moving into the utility phase, where users are able to generate yield on their crypto and engage

beyond crypto's first use case: investing. Approximately 28% of our retail MTUs both invested and engaged with at least one other product in Q3. Further, 49% of our retail MTUs engaged with noninvesting products such as Staking, Earn, and Coinbase Card, including 2.8 million users who were earning yield on their crypto assets.

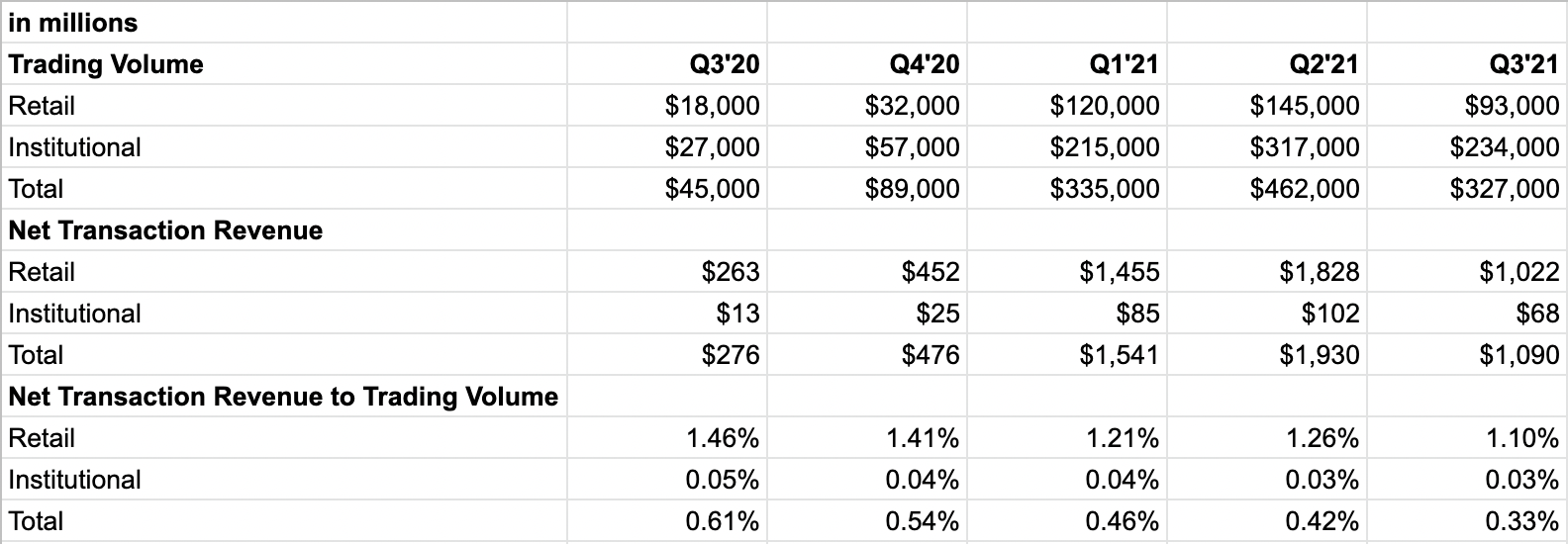

Net transaction revenue to trading volume declining

Net transaction revenue to trading volume has been falling. Specifically, assuming similar net transaction revenue to trading volume for Q3'21 compared to Q2'21, Coinbase would have made an additional $277m or 22% of total revenue.

Retail is the key to transaction revenue as institutional fee is minimal at 3bps. While there is no further disclosure, the retail transaction revenue should be driven by two use cases - investing (ie, trading) and non-investing (ie, payment for goods and services).

The investing transaction fee rate should continue to contract driven by competitive pressures. However, the non-investing transaction fee should be typically much higher (for example, Stripe charges 2.9% plus 30 cents per transaction to accept card payments online).

Therefore, as crypto becomes more common as a payment form, the transaction revenue should be boosted.

Investing in Coinbase is ultimately investing in the adoption of cryptos as a utility, by how fast and how large.

The short term share price will be due to fluctuations in cryptos' market cap but a decoupling may happen in the medium term. If this hypothesis is true then investing in Coinbase as if falls with crypto prices may make sense. However, this is premised on cryptos corrections being only short term and cyclical. Cryptos prices must be structurally at least stable to instil confidence in its usage. Therefore, a moderately upward trend is probably the best for utility adoption, financially speaking, technology ease of use aside. Though this maybe difficult to see given their trading nature and somewhat lack of fundamentals.

In addition, with the declining trading fees, industry participants need to invest in areas that will attract assets on platform (land grab) and some will win, some will lose so that's another risk investing in Coinbase is taking.

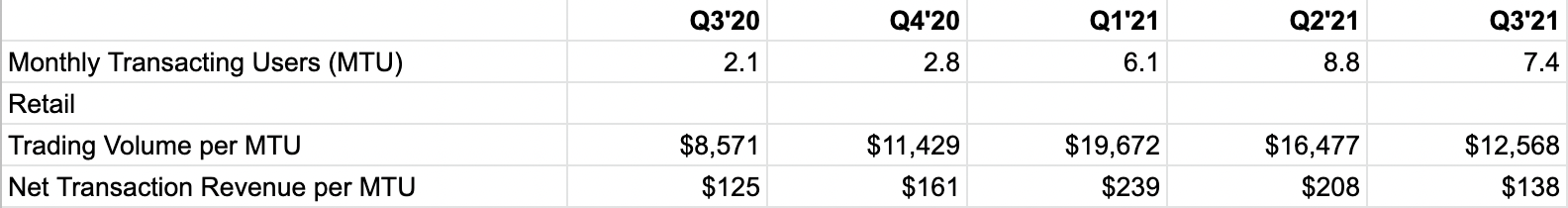

Number of Users Recovered but Not Volume

Monthly Transacting Users "MTU" recovered in Q3'21.

If we use Monthly Transacting Users "MTU" as a proxy to number of retail users (as number of institutional investors should be insignificant comparably), trading volume per MTU has continued to decline. This has led to lower Net Transaction Revenue per MTU (together with lower commission rates).

While Coinbase discloses Assets on Platform, this metric is not of much use unless it is further broken down into retail and institutional (together with number of users) so that the Assets on Platform per user by retail and institutional can be calculated to understand the underlying trends. At the moment, we cannot simply divide Assets on Platform by Monthly Transacting Users "MTU" as if institutional users are rising much faster then clearly this ratio will continue to rise.

What is clear, however, from the table is that Assets on Platform will just continue to trend upwards despite any near term volatility.

Coinbase did disclose the below,

Approximately 2.8 million users were earning yield on their crypto assets — predominantly through staking — at the end of the quarter.

implying about 38% of MTU.

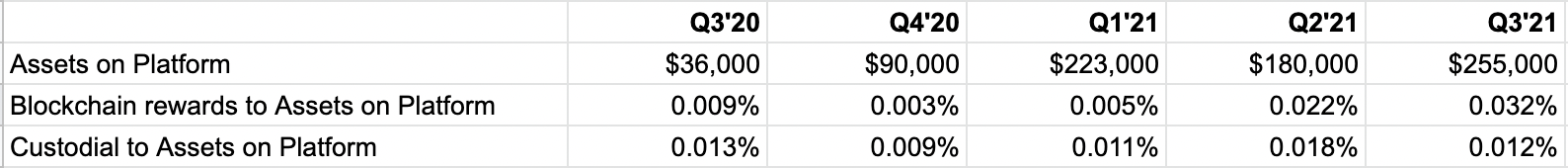

Subscription and Services Revenue depend more on proof-of-stake currencies

Blockchain Rewards and Custodial are the two key components within Subscription and Services Revenue.

Coinbase S-1 provides detailed descriptions:

Staking revenue (or Blockchain rewards)

The Company participates in networks with proof-of-stake consensus algorithms, through creating or validating blocks on the network. In exchange for participating in the consensus mechanism of these networks, the Company earns rewards in the form of the native token of the network. Each block creation or validation is a performance obligation. Revenue is recognized at the point when the block creation or validation is complete and the rewards are available for transfer. Revenue is measured based on the number of tokens received and the fair value of the token at the date of recognition.

Custodial fee revenue

The Company provides a dedicated secure cold storage solution to customers and earns a fee, which is based on a contractual percentage of the daily value of assets under custody. The fee is collected on a monthly basis. These contracts typically have one performance obligation which is provided and satisfied over the term of the contracts as customers simultaneously receive and consume the benefits of the services. The contract may be terminated by a customer at any time, without incurring a penalty. Customers are billed on the last day of the month during which services were provided, with the amounts being due within thirty days of receipt of the invoice.

While both metrics should on paper be functions of Assets on Platform, this is not entirely clear from the figures especially Blockchain Rewards.

In theory, increasing proof of stake currencies in Assets on Platform should boost Blockchain Rewards. Therefore, if Coinbase breaks down Assets on Platform by proof of stake and proof of work, the underlying trend maybe better understood.

As per the following extract from Coinbase's Q3'21 Shareholder Letter,

This backdrop led to global crypto spot trading volumes declining 37% in Q3 as compared to Q2, however, Coinbase outperformed the market with total trading volumes of $327 billion, a 29% decline in the same period.

Coinbase is taking market share but ultimately still needs the market cap of proof of stake currencies to increase to boost Blockchain Rewards. Hence, this is one of the fundamental differences between investing in Coinbase compared to purely in Bitcoin or Ethereum, both are proof of work.

Coinbase's strategy is to list all legal assets so structurally, they will continue to have more proof of stake currencies.

Coinbase also mentioned,

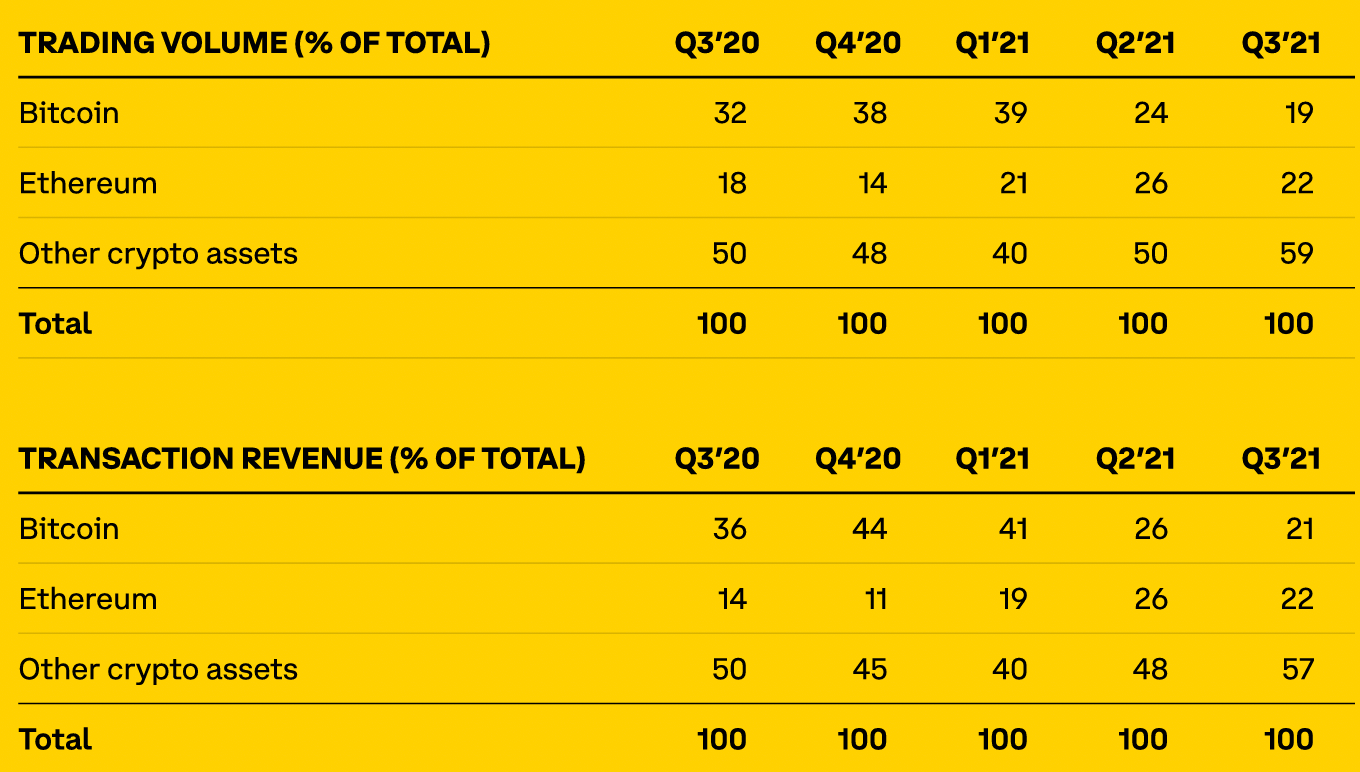

Trading volume from Other Crypto Assets comprised 59% of our total volume in Q3, up from 50% in Q2. This compares to Other Crypto Assets comprising approximately 42% of the total crypto market capitalization as of September 30, 2021.

Though this statement maybe inconclusive as it may not be a like to like comparison as Other Crypto Assets may have higher trading velocity (ie, trading volume to market cap) so Other Crypto Assets' trading volume as % of total is bound to be higher than Other Crypto Assets' market cap as % of total.

Perhaps somewhat counterintuitive is Other Crypto Assets transaction revenue as % of total has always been lower than Trading Volume, which implies the commissions for Other Crypto Assets is actually lower than Bitcoin and Ethereum.

This is despite...

Bitcoin and Ethereum constitute a larger share of institutional trading volume

compared to retail although we are starting to see institutions increasingly

diversify into Other Crypto Assets as well.

...institutions (with their much lower wholesale fees) trade more Bitcoin and Ethereum.

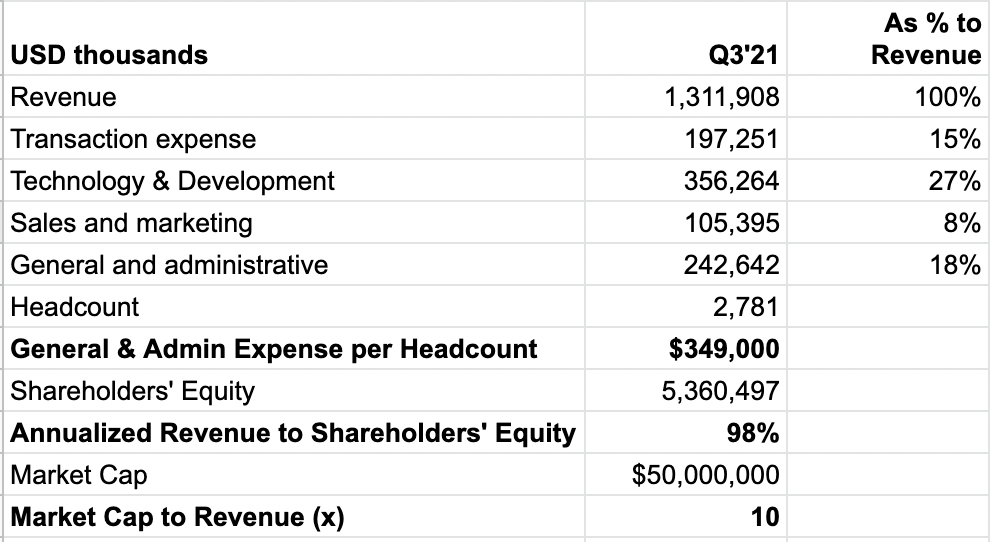

Some Key Metrics

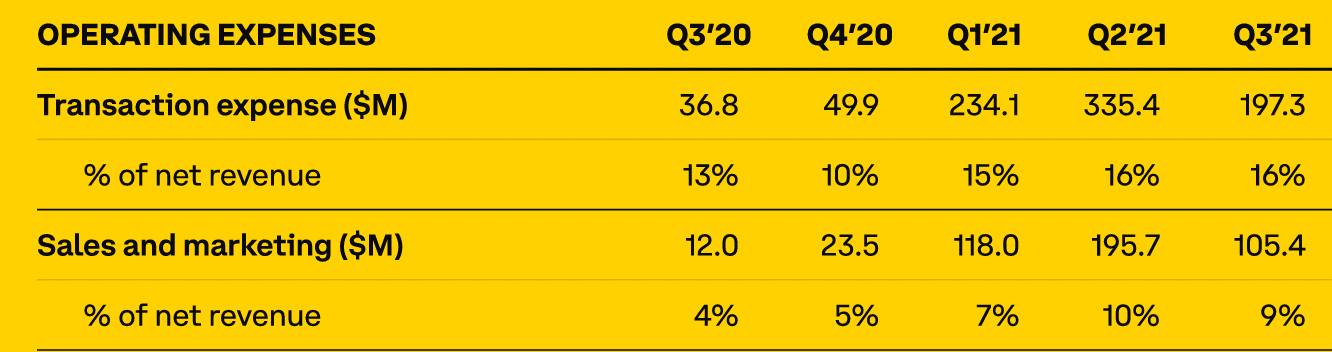

Sales and marketing account for a low percentage relative to other expenses...

...and has been that way historically.